We have been developing a few tips over the last few weeks to try and help you all find a way to build an opportunity within this upheaval. Of course, it is difficult to ensure you continue to build your online exposure however, rest assured, people are out there looking online for your product and services and importantly, many of your competitors have withdrawn from the market. Therefore, there is real potential for those that are aggressive through this time to maximise the opportunity that there can be.

I have been reading many articles over the last few weeks about the ideal way to generate traffic through this COVID-19 time. I have also read an extremely informative article based on how the pandemic is affecting different industries.

The following article, originally produced by the search agency FOUND, highlights some of these points.

The report is extremely detailed; therefore I have picked out the particular sections I believe to be the most informative.

The Introduction.

We all know that the Coronavirus is having an impact on our lives. In the following report, the agency have detailed the latest insights into exactly how the COVID-19 lockdown is actually impacting many different industries around the globe. This is delivered through detailed search data.

It is an attempt to quantify the impact on consumer interest by looking at actual search requests made on Google as well as the level of confidence investors have in the economic viability of particular industries by looking at market returns.

What sets this analysis apart from similar items is that FOUND have taken a strongly educated guess at what 2020 might have looked like without coronavirus in order to benchmark the reactivity of different industries.

This analysis therefore has context by asking “how much better or worse are industries doing in comparison to where they should be?” rather than “how are they performing?”

What follows is a guide to help you either look at the impact as a whole or drill into more specific and niche industries.

The Methodology.

1. Raw data.

Google is a part of most peoples’ daily lives. It is the world’s leading and most popular search engine with almost 2 billion users worldwide and therefore clearly has a keen insight into what people around the world are interested in. Just as interesting, is Google’s data collection of the tens-of-thousands of search queries made every second, which allows users to view and analyse this useful data for marketing and research purposes. This is why FOUND chose to use Google Trends to analyse how interest in various topics has been impacted by the COVID-19 outbreak.

Google Trends can be an extremely useful tool for reviewing a company’s digital marketing strategy, especially when we mine the raw data to predict the next wave of popularity or, in this case, paint a picture of what 2020 was supposed to look like. This enables you to look back across history at how the popularity of any given topic has changed.

2. Deseasonalisation to unearth trends.

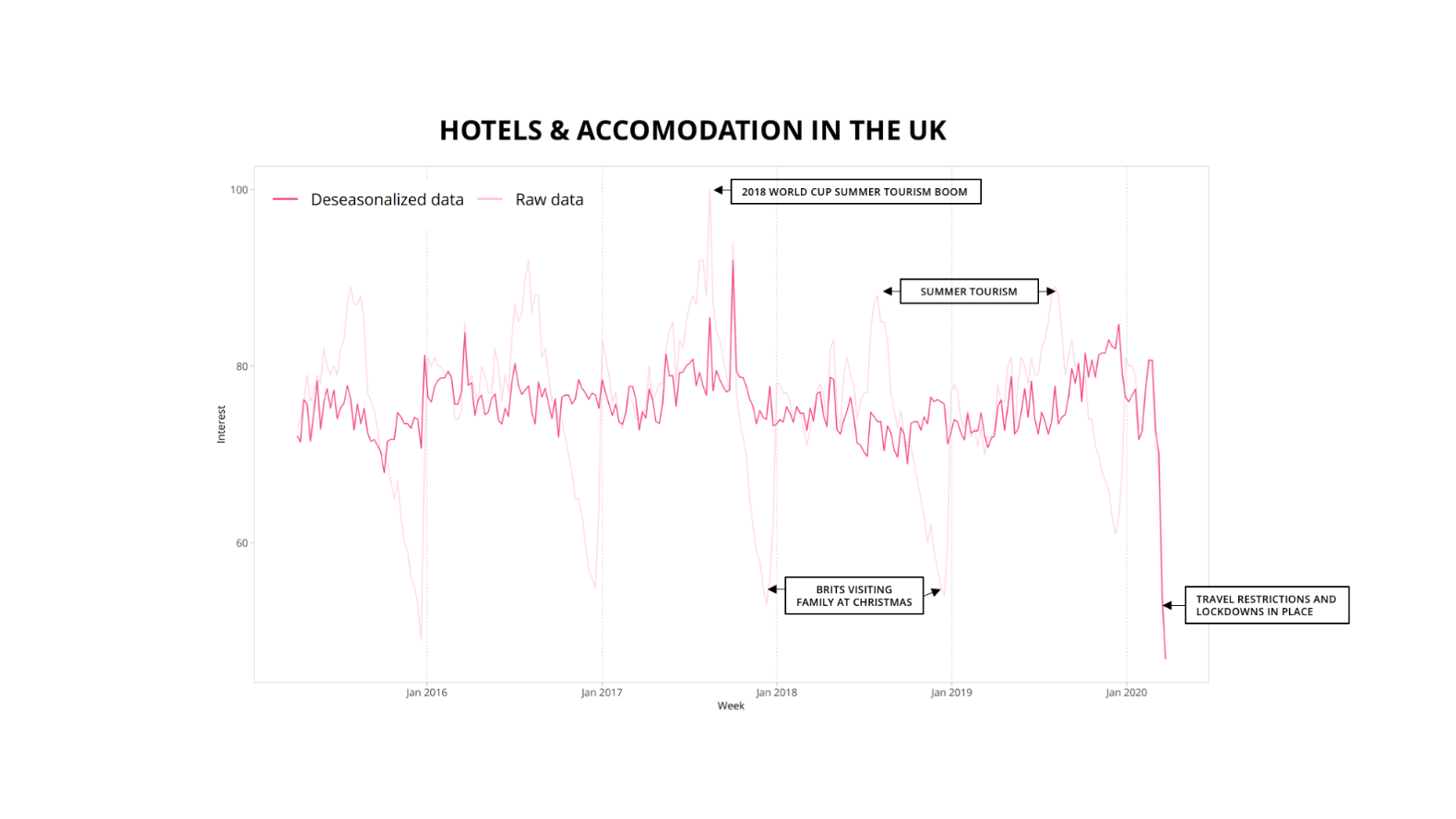

FOUND downloaded the last five years of “interest” data across 274 different industries in 14 different countries through the Google Trends API. The first step was to flatten out any seasonal effects in the data (e.g. “Christmas trees near me” spiking at Christmas). This is standard econometric practice used when forecasting a time series. It removes seasonal patterns underlying the raw data allowing one to look at the trend and other unexplained fluctuations in isolation from seasonal shifts.

For example, the following graph shows how the highly repeated seasonal pattern (where it reliably peaks around the summer and dips around Christmas every year) in interest in “Hotels & Accommodation” across the UK can be levelled out to expose the raw trend and any other unexplained movements.

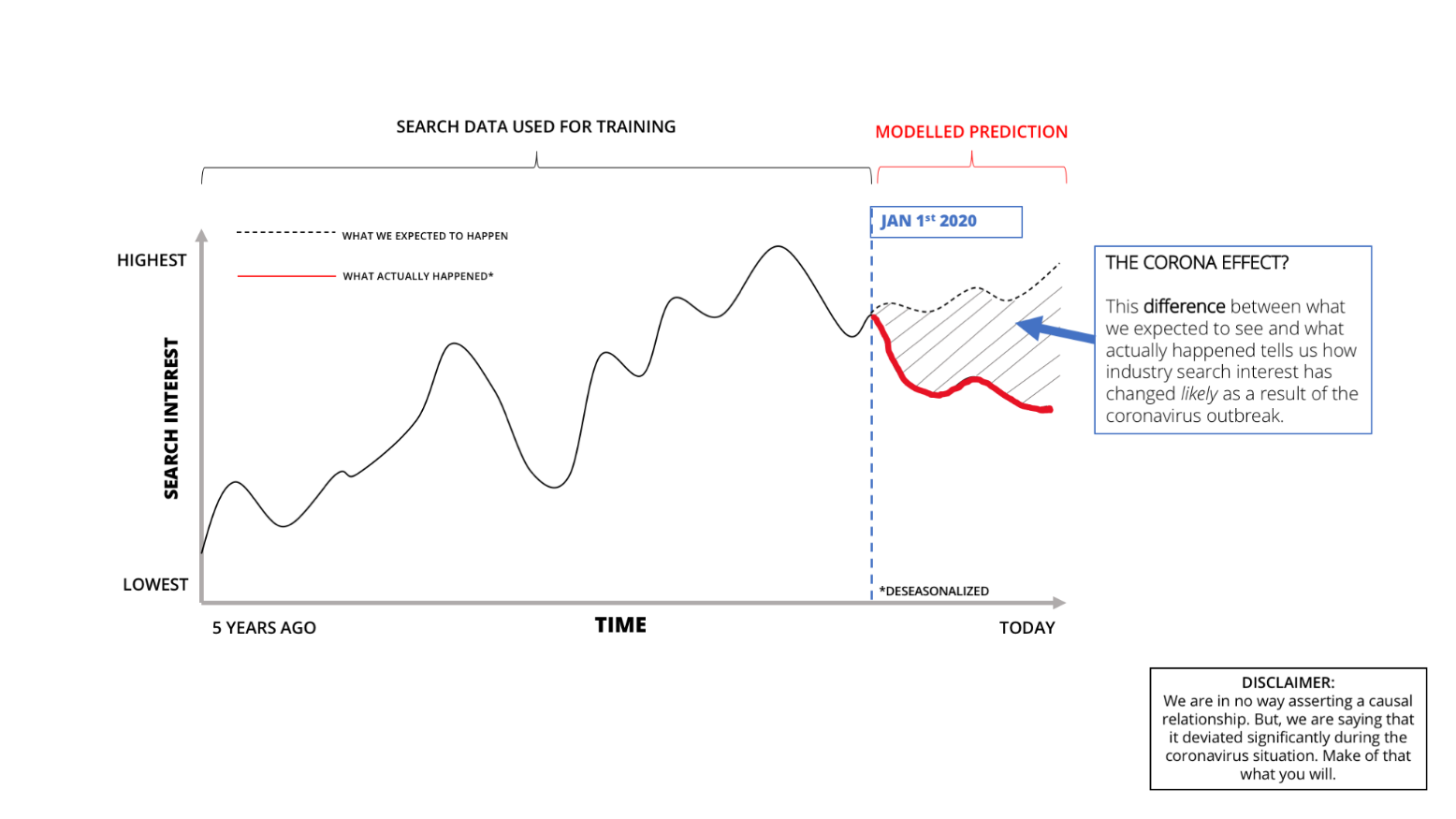

3. Finding the search divergence.

There was a predictive model trained for each category-country combination based on all data from 2015 to 2019. This then enabled a “best guess” at what 2020 should look like based on historic performance.

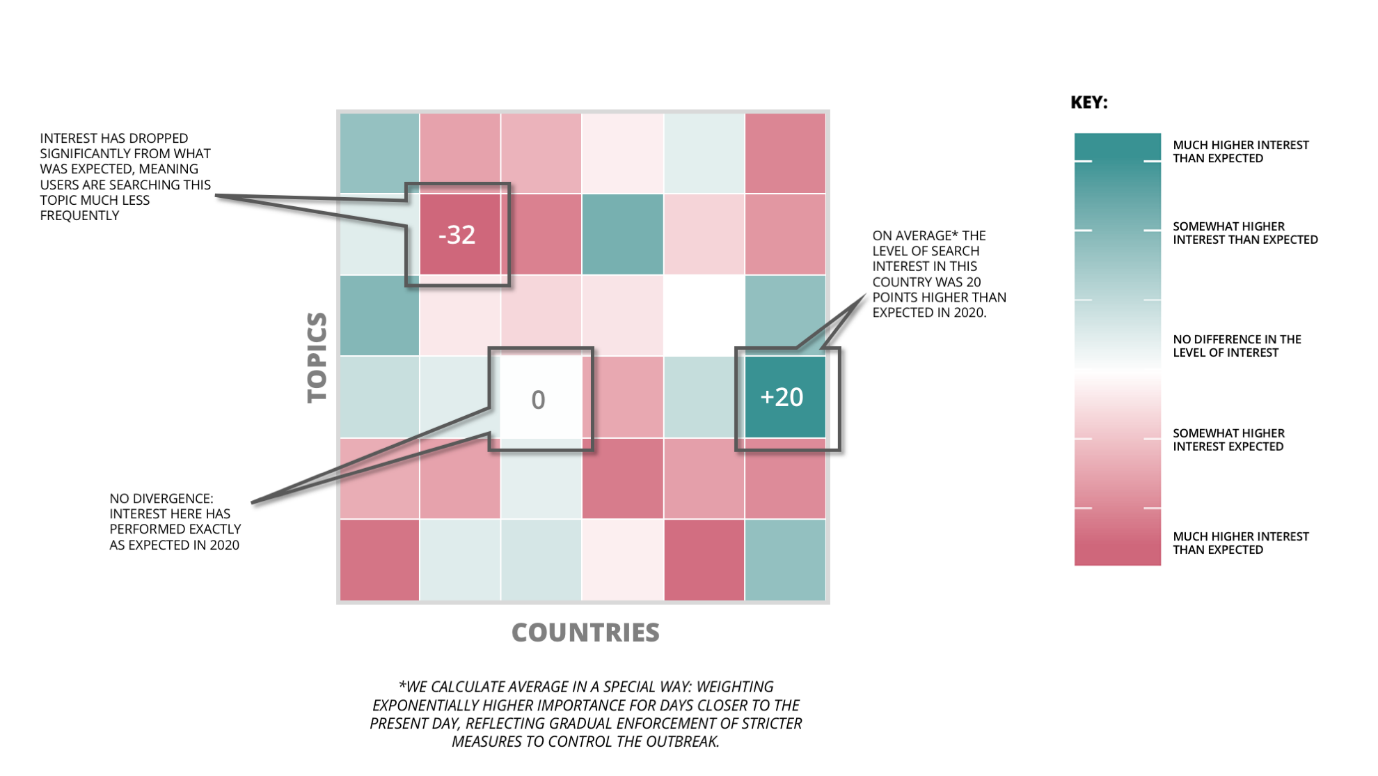

4. Mapping the impact.

The Results.

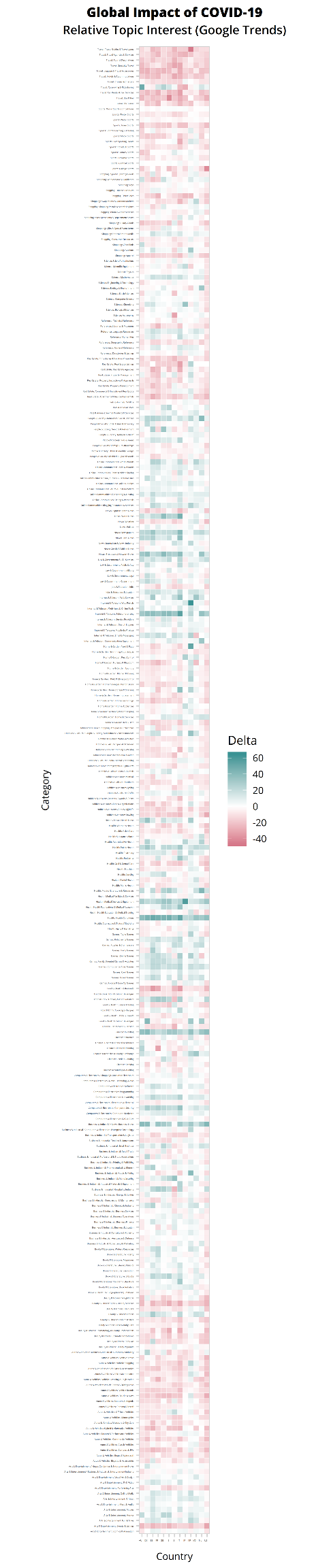

Below is a heat map array of how each industry has been impacted in each country analysed. Some industries have responded really well to the virus outbreak whilst some are trying to absorb a massive hit. It does show that many industries are relatively unaffected. The following image details an overall painting of all topic categories around the world.

The Winners and Losers.

The above waffle plot has been distilled into winners and losers to pick out the topics that are thriving and the ones that have received the most severe drop-off in interest.

1. The winners.

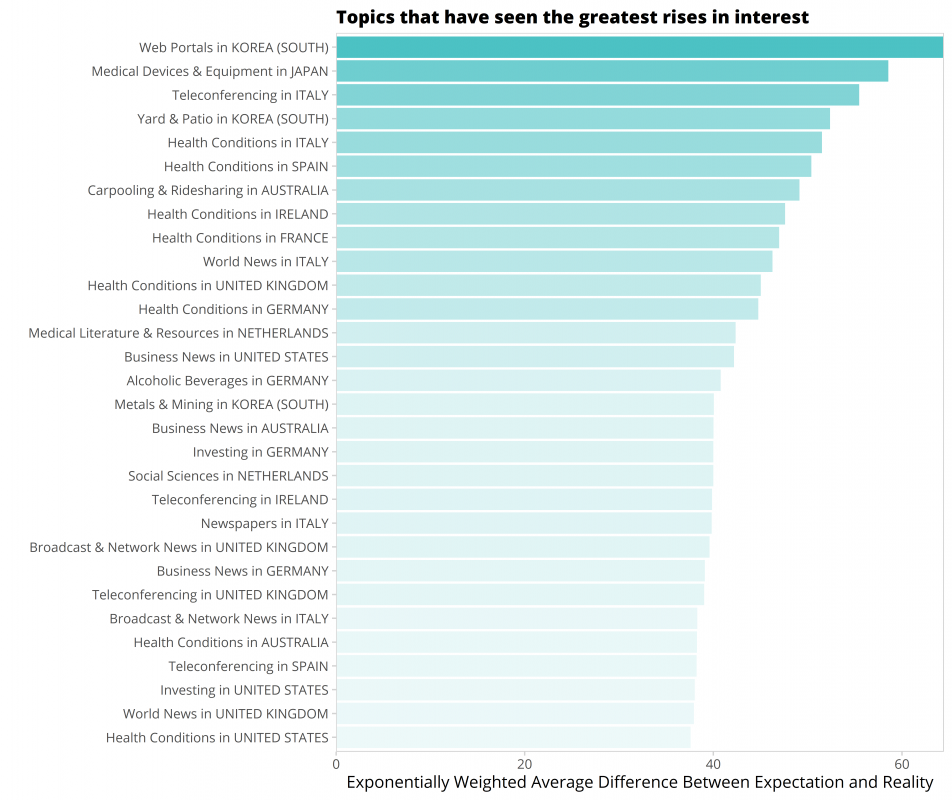

We can now see the top 30 industries that have improved though this period:

1a. Key winner takeaways.

Many topics on this list are a given, such as medical equipment and news however, some are more interesting such as:

• The alcohol and business news markets in Germany are high on the list.

• Teleconferencing is also well searched in the UK, Ireland, Spain and Italy.

• Interest in health conditions in Italy and Spain. This is maybe in line with the countries’

older age profiles.

• Carpooling and ridesharing in Australia delivers a significant increase

2. The losers.

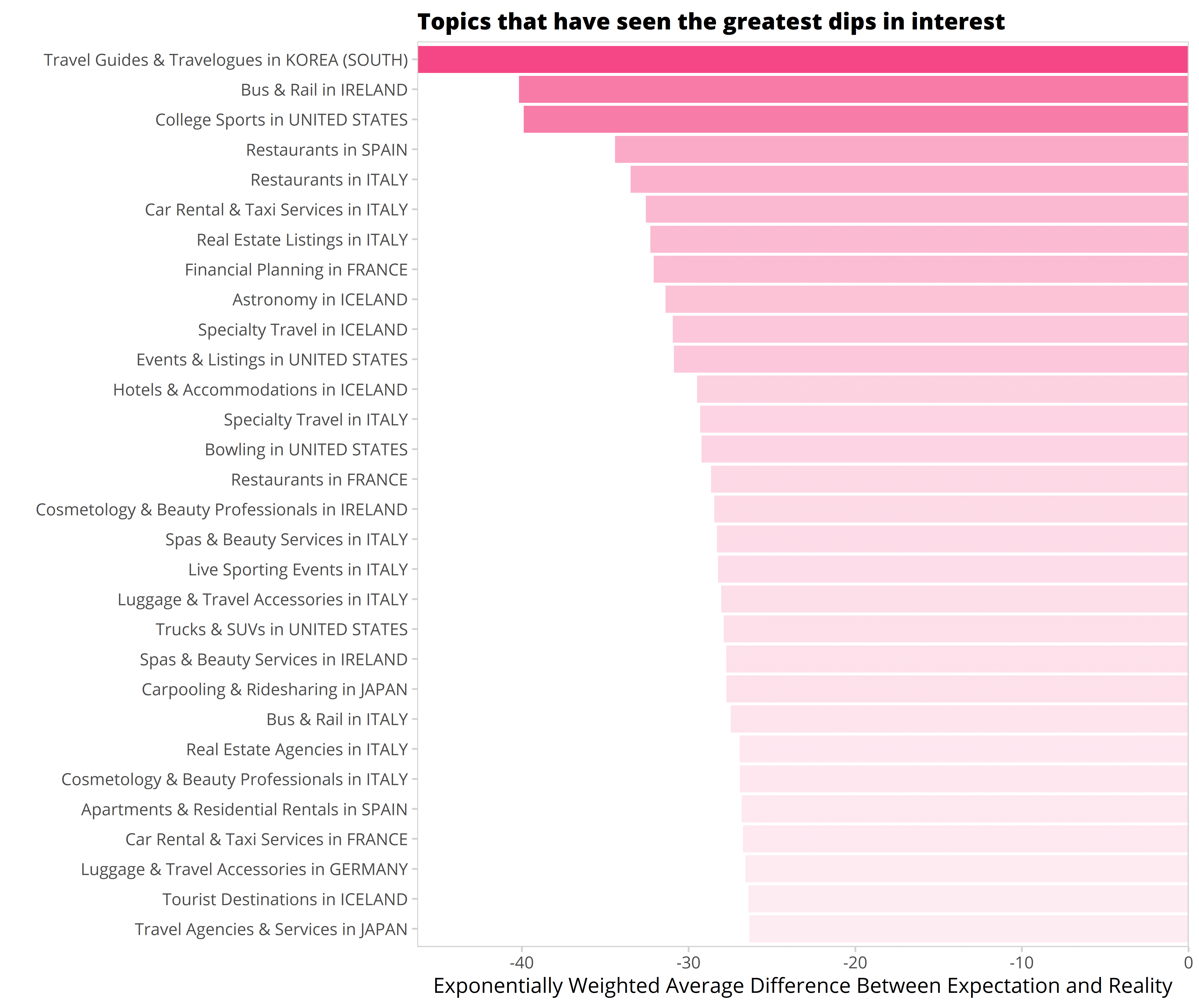

Equally, we can see the 30 industries struggling to maintain peoples’ attention:

2a. Key loser takeaways.

Unsurprisingly, restaurants, live sporting events and travel are taking some of the greatest hits. Again, there are some more novel findings:

• Travel guides in South Korea are probably receiving a fraction of the search volume they once

enjoyed.

• In Iceland sky gazing and browsing tourist destinations has significantly dropped.

• The beauty industry in Italy is really struggling.

• Ireland are no longer searching for any public transport.

Categories of Interest.

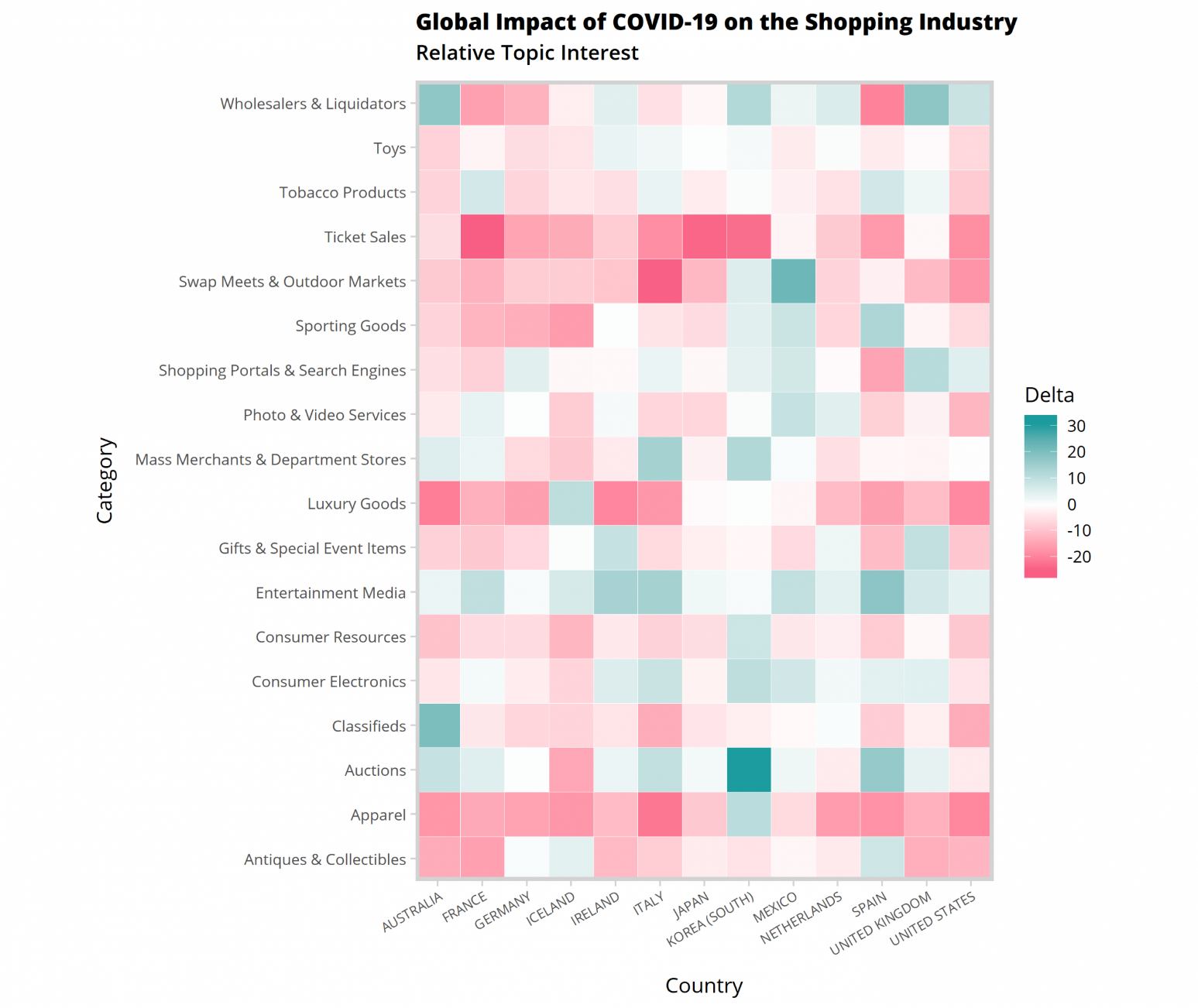

We can now drill down into particular topics to uncover any aspects of wider interest that are doing well despite the overall trend. For example, the shopping industry.

1. The shopping industry takeaways.

The shopping industry is a mixed bag. Interest in ticket sales, outdoor markets and luxury items have all dropped significantly however, it is good news for digital marketing as shopping portals and search engines soar in popularity across the UK compared to where they normally are.

The question therefore is, what are they buying? By looking at the UK market we can see the areas that have improved are the wholesale industry, shopping portals and search engines, gifts and special event items, entertainment media and consumer electronics.

As we are all on lock down it’s unsurprising how social media and teleconferencing activity has seen a much higher demand. But what is interesting is how people choose to connect online. Virtual worlds have seen the largest jump in popularity, rising more than 20 interest points above the expected level.

2. The Stock Market.

Another way to gain insight into how industries are performing is to look at the global stock market. Over 7,000 stocks from around the world were analysed in an attempt to understand how investors perceive the economic viability of various industries. This is not aimed at trying to predict how the stock market will behave; its more an attempt to understand how, given the last 5 years, what might 2020 have looked like?

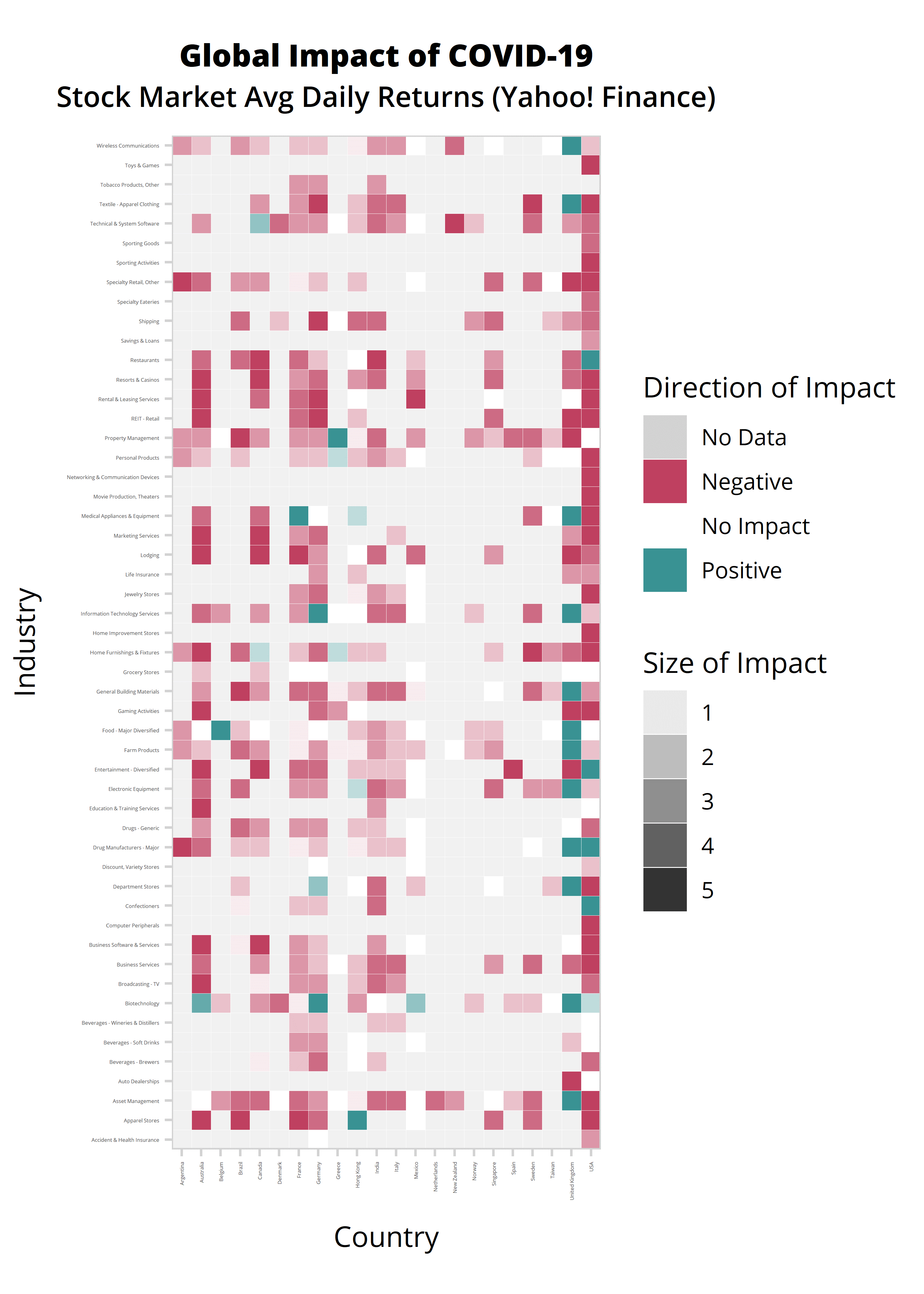

Below is a very similar heat map to the one above for trends, but this time just for stocks.

2a. The stock market takeaways.

At an initial glance it looks like bad news and there are some noteworthy insights:

• Asset management companies in the UK seem to be weathering the storm, which is not the case in

any other country analysed

• Marketing services are struggling in most countries but in the UK they have not struggled

anywhere near as much.

• US entertainment services such as CBS, AMC, FOX, IMAX etc appear to be performing well, rising

above market expectation by 2-3%

I hope this information has been interesting for you and indeed, does point out that there will be winners and losers through this upheaval. The winners will be those that look for and exploit opportunities.

For more information then please get in touch with us here at Pure Digital.